The end of Tether scandal: a new financial order20 minuti

The auditor Friedman LLP interrupted the inspection of Tether’s financial statements without a final verdict. Similarly, no official news followed the subpoena launched by the US authorities. If Tether is compliant, why Bitfinex nor US authorities have released any information? This article provides an answer to this question, revealing also why this story hides something much bigger, which could change the equilibrium of the economy and finance of the world as we know it.

Index of contents:

– A few words about Tether and the Omni Protocol

- Tether transaction on Bitcoin blockchain

- Main Tether movements between exchanges

– Relationship between Tether and Bitfinex

- Deposit and withdrawals at Bitfinex

- USDT emission and parity with the US Dollar

- Where is the scam?

– Audit and Subpoena: what’s going on

- Auditors are afraid to step out of line

- The smaller banks are afraid of the exclusion from the system

- CFTC subpoena to Bitfinex

- A new financial equilibrium

– A few words about Tether and the Omni Protocol

On each platform where cryptocurrency and dollars can be exchanged, the USD ticker represents the dollars that the user owns. If Alice buys 1,000 USD from Bob on Kraken, she sees the 1,000 USD digit to appear in her account. This is simply because some data is modified on the Kraken database due to an input from the trading engine.

Since the internal accounting operations of the exchange are not transparent to the public, Alice does not have the certainty that Bob really owned the 1,000 USD he sold to her. Bob may be a Kraken employee who just changes the number in the database as he likes, crediting 1,000 “USD” to be exchanged for Alice’s bitcoins. When Alice tries to clear her bank account, she will find out that those dollars do not exist, but now she has sold her bitcoins. That this scam occurs is unlikely, but theoretically possible, and a well-known twitter account accuses the world’s largest cryptocurrency exchange, Bitfinex, of attempting this fraud.

Bitfinex makes no difference between tether dollars and real dollars, USD and USDT: when we use USDT, we trust that behind the digit on the platform there are actually dollars, which is the same assumption we do about the USD on Kraken or GDAX. Until the withdrawal, we can’t be sure those funds exist. In reality, this certainty does not even exists for the euro and dollars in traditional banks, since they practice fractional reserve and literally have never enough funds to cover the quantities nominally available to the account holders.

The difference between USD and USDT token is essentially the way of book-keeping: USDT is not just a number in a centralized database, but is registered in blockchain, then it can be used as a cryptocurrency. In fact, USDT movements outside an exchange are public and transparent to anyone, which is why users can move tether dollars from wallet to wallet without having to rely on Bitfinex or any intermediary, bank or central bank. Tether then becomes a bearer security, like a dollar bill, redeemable exclusively at Bitfinex.

1. The Tether transaction on Bitcoin blockchain

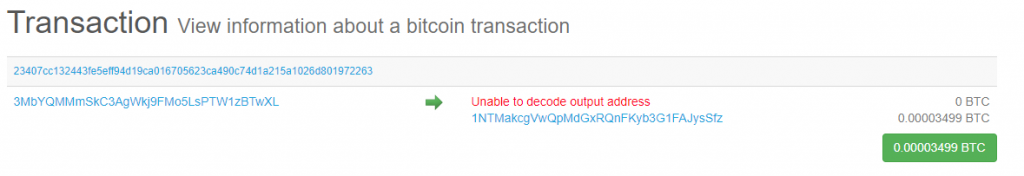

The Tether transaction (USDT) is written in the Bitcoin blockchain through the Omni Protocol, thus ensuring the certification and publicity of transactions. This is a Tether transaction seen with the well-known Bitcoin block-explorer blockchain.info:

https://blockchain.info/tx/23407cc132443fe5eff94d19ca016705623ca490c74d1a215a1026d801972263

Blokchain.info is a blockexplorer used to read Bitcoin transactions, so it does not recognize the output of this transaction: “unable to decode output address” (written in red in the screenshot). In fact the receiving address is not Bitcoin, but Tether, though it benefits of the security of the Bitcoin blockchain. There is obviously a bitcoin input, of very small amount, which is needed to pay the miner to validate the data into the blockchain, but this data can only be decrypted using specific software capable of reading the Tether protocol, such as Omniexplorer.info. In the specific case, it is a transaction of 250 million USDT, whose hash corresponds exactly to the hash of the relative bitcoin transaction:

https://www.omniexplorer.info/tx/23407cc132443fe5eff94d19ca016705623ca490c74d1a215a1026d801972263

Some of the biggest exchanges have installed a Tether wallet to list the crypto USDT, so that users can withdraw tethers from Bitfinex and deposit them on Poloniex, Binance, Bittrex etc.

Any exchange trading USD dollars is forced to verify users through KYC & AML procedures, but at least in certain jurisdictions, it can completely bypass these checks if it only exchanges cryptocurrencies, such as USDT (Bitfinex requires ID verification in any case). As long as Tether is commonly considered a valid security on the underlying dollar (regardless of the legal status), it is possible to transfer a title of ownership on dollars bypassing completely the banking circuit, freely moving value over geographical barriers and jurisdictions. However, this security can only be redeemed on Bitfinex, so the system only holds if for every tether in circulation there is actually a dollar in the treasury of the exchange.

Currently there are more than 2.5 billion USDT, which should imply that users have deposited at least this amount of dollars on Bitfinex and that these dollars have remained in the availability of the exchange. The question posed by many is whether these numbers are real.

2. The main Tether movements between exchanges

The main movements of Tether are between exchange platforms (especially Bitfinex, Binance, Poloniex and Huobi) because users and especially big traders (the so-called whales) send huge amounts from one platform to another to do arbitrage. Thanks to Tether, moving a token that is stable and tied to the dollar is very quick (and without “bureaucratic” friction) compared to a transfer in dollars, so traders take advantage of this speed to speculate on the price differences of the other cryptos.

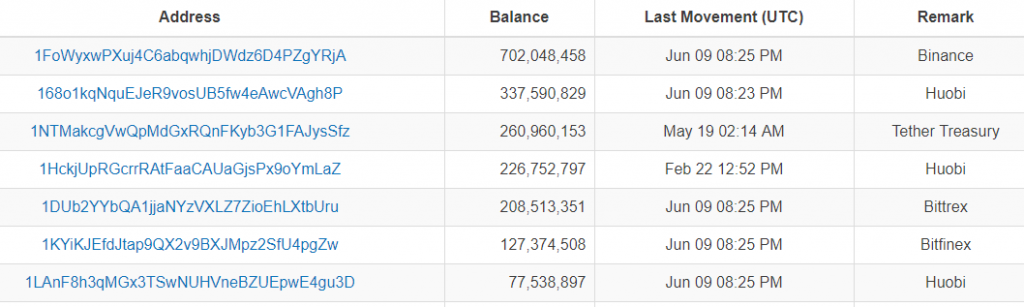

Binance has greater trading volumes than Bitfinex, but it doesn’t allow to deposit or withdraw fiat money, only cryptocurrencies. That explains why Binance holds the greatest USDT wallet with over 700 millions. Also other colossi of crypto trading, Huobi, CeX and Bittrex, replace dollars with tethers. Here is the list of the richest addresses:

https://wallet.tether.to/richlist

This table is not updated at the last minute. For example, the Poloniex cold wallet is not in the list when I am taking this screenshot. For quicker updates, check the richlist on blockspur: https://blockspur.com/tether/richlist

Here it is possible to see 220 millions USDT in the Poloniex cold wallet (click on the link to see the live quantity):

https://blockspur.com/tether/addresses/1Co1dhYDeF76DQyEyj4B5JdXF9J7TtfWWE

This is the Poloniex hot wallet:

https://blockspur.com/tether/addresses/1Po1oWkD2LmodfkBYiAktwh76vkF93LKnh

The Bitfinex hot wallet has 130 millions:

https://blockspur.com/tether/addresses/1KYiKJEfdJtap9QX2v9BXJMpz2SfU4pgZw (Bitfinex hot wallet)

At the time of the audit the Tether treasury address (cold wallet) was 3BbDtxBSjgfTRxaBUgR2JACWRukLKtZdiQ (as it is possible to see from the documents below). Today the treasury moved to the following address: 1NTMakcgVwQpMdGxRQnFKyb3G1FAJysSfz:

https://blockspur.com/tether/addresses/1NTMakcgVwQpMdGxRQnFKyb3G1FAJysSfz (Tether cold wallet)

It’s easy to trace tether movements from the creation address to the Bitfinex cold wallet and hot wallet, just start from the creation address:

https://www.omniexplorer.info/address/3MbYQMMmSkC3AgWkj9FMo5LsPTW1zBTwXL (Tether creation address)

It is also interesting to observe the transactions between Huobi hot and cold wallet (of about 80 and 330 million dollars respectively): between these two addresses there is a constant back and forth with infrequent transactions of very high amounts (12 millions on average).

https://blockspur.com/tether/addresses/1HckjUpRGcrrRAtFaaCAUaGjsPx9oYmLaZ (Huobi)

Just a curiosity: the following is the address of the hacker who attacked Tether. The USDT have been frozen and can no longer move: https://www.omniexplorer.info/address/16tg2RJuEPtZooy18Wxn2me2RhUdC94N7r

As we can see from the blockchain, there are billions of USDT actually circulating between exchanges (and probably some personal wallets), which means that Bitfinex should hold at least an equal amount of dollars. But what if not? In that case the truth will sooner or later come to the surface and Tether price will collapse. The loss doesn’t affect the exchanges, but only the users who at that time are holding tethers in their accounts, exactly as it would be in the case of any other cryptocurrency deafult. Those who believe Tether will drastically fail are free to open a short position on Kraken. Thanks to the possibility offered by Kraken to bet on USD against USDT, it’s transparent how much the players in the market are confident in Tether, even after the news of the subpoena launched by the CFTC.

– Relationship between Tether and Bitfinex

1. Deposit and withdrawals at Bitfinex

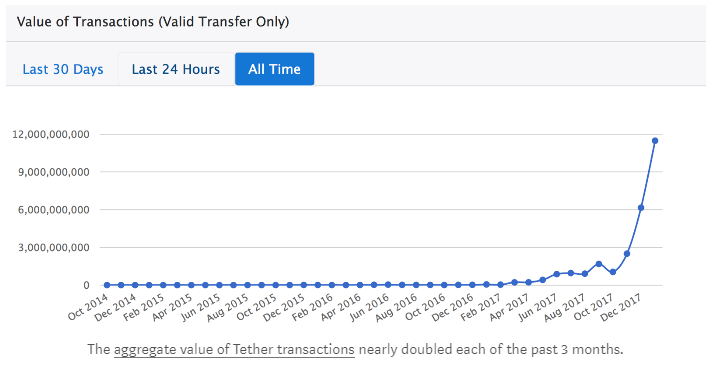

The generic users deposit and withdraw funds on Bitfinex through the company Cryptocapital, which deals with payment, anti-money-laundering and know-your-customer procedures on behalf of Bitfinex and other exchanges like CEX. Cryptocapital is specialized in opening banking channels, ensuring there is always an alternative way if some financial institutions close the doors to the cash flows. This solution has been necessary after that Wells Fargo shut down the transfers to the Taiwanese banks serving Bitfinex. Until summer 2017, Bitfinex relied on many different banks, but all in the same jurisdiction and all of them have been target of the ban from the correspondent US banks, suddenly preventing Bitfinex from sending and receiving money to the United States. Given the difficulties in moving dollars, the users quickly adapted to an alternative system and the use of Tether has increased dramatically: the chart shows the growth between June and December 2017. It should be noted that the 12 billion USDT moved in this period are much greater than the circulating supply, since a single coin can be moved back and forth many times.

2. USDT emission and parity with the US Dollar

The tether dollars are issued when the Bitfinex hot wallet is about to finish the USDT reserve. Assume that a user has deposited USD 1,000 via Cryptocapital on Bitfinex: at the time of the bank deposit in dollars, it is not necessary to create tethers, simply the depositor will find 1000 USD on his account. However, if this user withdraws 1000 tethers on his personal wallet, or sends them to an exchange like Poloniex, the user account is emptied of 1000 USD and the Bitfinex hot wallet sees an output of 1000 USDT. The number of Bitfinex dollars is likely to be greater than the tether dollars in circulation, since we expect there are not so many traders who move tethers outside Bitfinex as the number of those depositing dollars to keep them on the platform. As a result of the withdrawal in USDT from the Bitfinex wallet to another exchange, Bitfinex wallet may be short of USDT, so it requires a new supply from Tether ltd, in order to cover upcoming requests of withdrawals from the users.

The Tether emission take place in two consequential steps:

- First, Bitfinex make a transfer to the bank account of Tether ltd. This transfer is internal to the same bank where both Tether Ltd and iFinex Ltd have an account, so it is practically immediate (we will see later which bank it is).

- When Tether ltd receives the money it moves USDT from the creation address to the Bitfinex wallet. The transaction is done on Bitcoin blockchain via omniprotocol, thus requiring the times of the Bitcoin blockchain

The issue occurs exclusively towards a Bitfinex wallet, there is no other USDT distribution hub. For every single tether actually in circulation there is a dollar deposited on Bitfinex, because if a user withdraws 1000 USDT he has necessarily deposited at least 1000 USD, or he sold a cryptocurrency traded for the USD deposited by other users.

Could there be any USDT not covered by dollars? Even if it were so, there is no certainty it is a scam, at least we can imagine situations in which it’s not. The creation of USDT isn’t instantaneous and automatic for every dollar deposited, since tethers are created in blocks. If a user intends to transfer them, he will not be able to do so without the existence of already issued tokens. So if the Bitfinex hot wallet tends to zero, we can expect that Tether Ltd will issue a block of USDT to cope not only with a withdrawal request already forwarded by some users, but with a future series of expected withdrawals, in such a way that it’s not necessary to constantly organize new tokens emissions to meet users’ requests of withdrawals. In this case there is the (merely theoretical) possibility that non-covered tether dollars get into existence (in the creation address, not in “circulation”) and even such a situation could be legitimate, because it does not mean that any user can spend these newly created USDTs buying bitcoins or other cryptocurrencies. As long as users on Bitfinex have empty accounts in USD they cannot transfer tether dollars and make them circulating, at least without executing a new deposit in USD. Then the tether dollars would have been created in advance for a mere technical reason.

3. Where is the scam?

Suppose the operators behind Bitfinex were criminals, how could their fraudulent activity benefit from the use of Tether? As we have already mentioned, any exchange that does not use Tether could credit “from nothing” a fictitious USD amount on the platform and exchange it for other cryptocurrencies, keeping in reserve only a fraction of the USD cash deposited by users, so to cover a moderate request for withdrawals (expected in the short term). This system is well known to traditional finance and is called fractional reserve, so dear to all the old beloved banks. After creating some fictitious USD (or USDT) credited to some account on the platform, the exchange could disappear into nothing with btc, eth and other cryptos bought without actually giving anything in exchange for. From this point of view, Bitfinex has no advantage over any other exchange, since it is a scam that every trading platform, at least potentially, could put in place.

The risk for those who try a fraud of this type is that at some point user understand they can no longer withdraw the entire amount of dollars, realizing that the nominal amounts in their accounts is not real. When this scam is revealed there are serious consequences for the company, while owners and managers involved are punished by law. In the MTGox case, the exchange failed and was forced to pay compensation to users. The history of MTGox teaches that the justice works better for crypto exchanges than for the “highly regulated” traditional banks: when a “too big to fail” bank actually fails, those who bear the costs are the taxpayers, not the bankers and not even specifically the account holders who chose that institute as the bank in which to place their faith. If Tether is not covered instead, those who pay are Bitfinex and in general any user who owns USDT and who has misplaced his trust in the platform.

Bitfinex operators can issue tethers not backed by dollars, send them to other platforms and here exchange USDT for other cryptocurrencies. This is something that the operators of other exchange platforms cannot do. Still, the situation is only apparently different from the one described above. In fact, the risk is the same: sooner or later someone will be back to deposit these USDT on Bitfinex and claim for the USD. If this happens and there are no dollars enough, it will be a legal battle and iFinex will lose its reputation and business. When you are in the lead of such a money machine like the biggest crypto exchange in the world, the reasons to make in place a scam of this kind are not really clear.

– Audit and Subpoena: what’s going on

If all the dollars are there, why to not show it clearly to the world? There are basically two problems Bitfinex had to face with.

1. Auditors are afraid to step out of line

Until 2002 there were 5 big auditing companies, the so called Big Five:

- Ernst & Young

- Deloitte & Touche

- KPMG

- PricewaterhouseCoopers

- Arthur Andersen

They are called the “Big” because they audit the 99% of the FTSE100, which means the 100 companies with the highest market capitalization on the London Stock Exchange (and the 96% of the FTSE250). Only Deloitte has 38.8 billions in revenue. Despite their strong position, a huge mediatic exposure make them subjected by such a pressure that a single mistake could indelibly compromise their reputation and business, as history proves.

Of the Big Fives, there remain only four since 2002, after the fraudulent bankruptcy of the Enron Corporation, a society of Houston (Texas) which performed an incredible growth for years thanks to book-keeping tricks. The scandal hit Enron as well as its auditor Arthur Andersen, which was one of the Big Five. This single episode led to the end of the auditing company, since its State licenses have been revoked and the society dissolved together with its 9 billions revenue.

The big auditors are often over-payed for their job, but are also terrified of the possibility of making a false move. There are well known cases in which the auditing company prefer to suspend their work rather than providing official certification, only for KPMG in Italy we have several examples: the Zucchi case, the interporto of Bari (UE institutions granted the funds, despite the auditor judgment) or the Arquati s.r.l. [this article was originally written in Italian for albertodeluigi.com].

In order to audit a company working in the world of cryptocurrencies, there are many technical and jurisprudential considerations to take into account. Are the principles of law clear enough to foresee what would happen if the SEC or US legislator would intervene? Even a collapse due to cyberattack could endanger the FLLP reputation in case it fully approved Tether business. Since it’s so difficult to assess business continuity under so many unknowns and complications, why the auditor would risk its business when it can simply leave the client instead? Friedman LLP earned hundreds of thousands of dollars for months of work facing matters that are technologically unexplored and borderline legal situations. For example, can a company issue a security on the US dollar, allowing everybody to transfer that security in a peer to peer way without the blessing of the US administration? In the end, we can understand why FLLP left without a final response.

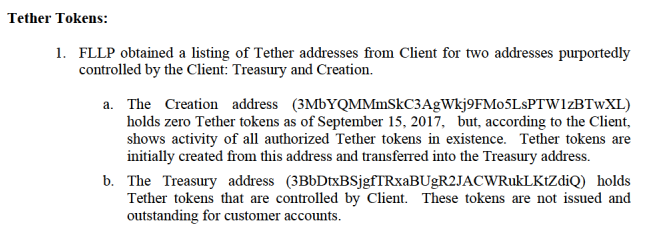

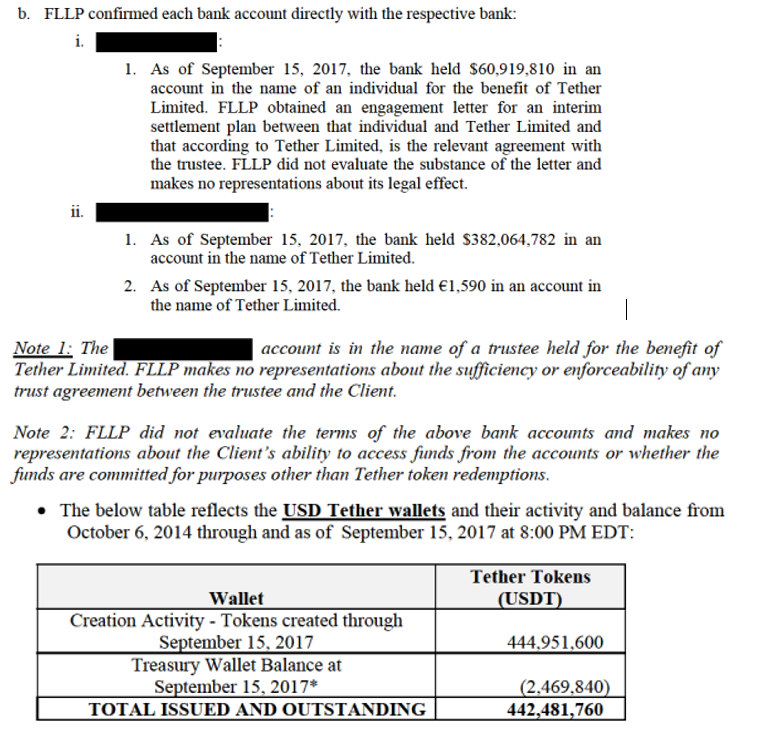

However, FLLP didn’t leave Bitfinex completely empty-handed. The auditor had access to data and accounts and produced detailed documents, the last on 28 September 2017. Here FLLP wrote that what is tracked by the omniexplorer.info tool “matches the information provided by the Client” (see https://tether.to/wp-content/uploads/2017/09/Final-Tether-Consulting-Report-9-15-17_Redacted.pdf). At that time the Tether issuance amounted to only 440 million dollars and FLLP certified the presence of an account of 382 millions entitled to Tether Limited, beside other 61 millions held in an account of a third individual “ for the benefit of Tether” (according to a written agreement). The sum covers the 440 millions of tether in circulation.

Something it is worth to notice is that in the report appear black censor bars to hide the name of the bank where dollars are held. Why so many secrets? Where does Bitfinex hide the money? Here comes the second problem faced by the company.

2. The smaller banks are afraid of the exclusion from the system

The traditional financial operators have a suspicious attitude towards the cryptocurrency world. The medium-small banks are afraid of the exclusion from the main channel of credits precisely because of their activities and services related to cryptocurrencies, just like happened to the Taiwanese banks serving Bitfinex in the Wells Fargo case. From this point of view, the fragility of the minor banking institutes to the mediatic exposure is similar to the one of the auditor societies. This is the reason why the banks serving Bifinex prefer to not reveal officially its partnership with a crypto exchange, avoiding this way the media and too many attentions. However, both Bloomberg and a Bitmex report revealed the evidences that the bank is Noble, based on Puerto Rico. Being in a US territory (not incorporated), Noble is actually an American bank. According to its by-law the only service Noble can offer is the custody of funds, therefore the bank makes no investments and does not practice fractional reserve, holding the 100% of the amount deposited by clients. Moreover, Noble cannot accept transfers from and towards other banks if the owner of the origin account and destination account is not the same. As the majority of the minor institutes, it does not hold funds directly, but at a third party, which in this case is the Bank of New York Mellon. With its 371 billion dollars, the BNY Mellon is the tenth biggest American bank. Considering exclusively the custodian banks, namely those holding only deposits, it is actually the biggest in the world.

To handle it quietly, Bitfinex adopts an interesting strategy to receive large deposits of traders and societies: the user create his own account on Noble, then make a rebalancing of funds between his traditional account and the new one on Noble. At this point, the transfer of funds to Bitfinex is an operation internal of Noble, then invisible to the other banks. This way the user maintain privacy and it is easier to justify large transfers, since a rebalance of funds between his own accounts is not really suspicious, especially considering that the destination account is held into an American custodian bank.

The same operation occurs in other regions of the world with different intermediaries, since Bitfinex has several partnerships with insitutes located strategically such that it is possible to avoid huge transcontinental transfers of money. Clients who move minor amounts just use Cryptocapital instead.

The Bitfinex attention to clients’ confidentiality and its own privacy is also a good explanation of the reluctance to publish official information regarding the localization of the funds.

3. CFTC subpoena to Bitfinex

Apparently the US regulator doesn’t appreciate lack of transparency in the name of privacy. The Commodit Futures Trading Commission (CFTC) the last 6th December sent a subpoena to Bitfinex (and also to Friedman LLP), which compels the recipient to appear in court as a witness. A subpoena is not a summon, that means Tether ltd or iFinex ltd are not sued.

In the case of a subpoena, the witness cannot publish relevant news about the inquiry without risking penalties. On the other side, the CFTC is not obliged to make public pronunciations. It’s clear that the CFTC is going to maintain absolute confidentiality about the (potential) investigations; in fact the commission denied a request of information (FOIA: Freedom of Information Act) forwarded by an anonymous intended to see this entire thing through. The official answer to the FOIA is that “disclosure of that material could reasonably be expected to interfere with the conduct of the Commission’s law enforcement activities”. https://www.coindesk.com/cftc-denies-bitfinex-foia-request-citing-possible-investigation/ (it’s a 6 june news). Probably the lack of information from Bitfinex during these months is due to the fact that the CFTC imposes the secrecy.

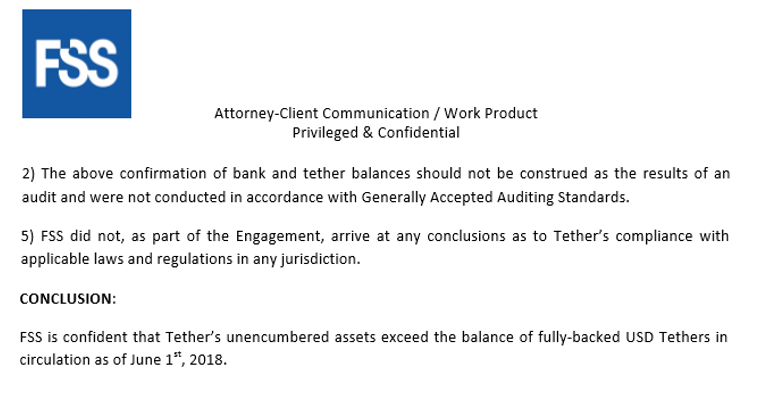

For the year 2018, Tether ltd engaged a legal advisor “Freeh, Sporkin & Sullivan LLP” (FSS) to review bank account documentation and to perform a randomized inspection of the numbers of Tethers in circulation and the corresponding currency reserves. FSS is an American law firm based in Washington, and confirmed that all Tethers in circulation as of June 1, 2018 are fully backed by existing USD reserves.

It should be noted that FSS performed just a legal review of the bank account documentation, not a full audit of the Tether business, so the final judgement of FSS implies very different responsibility than a full audit by Friedman LLP.

Here is the complete report (a partial extraction in the screenshot below):

https://tether.to/wp-content/uploads/2018/06/FSS1JUN18-Account-Snapshot-Statement-final-15JUN18.pdf

Should we trust in FSS statement and in the last report Friedman LLP published in September 2017? even if no one represents a full audit? One thing is clear to the entire world: the day of the subpoena, wednesday 6th December, Tether market cap was about 800 million dollars; today there are more than 2.5 billion tethers in circulation. If the CFTC had found irregularities, would ever Tether ltd dare to triple the amount of issued token, just in front of the eyes of the regulator? When something is wrong, the administration typically sends a letter of “cease and desist”. In that case, Bitfinex should have immediately ended its activities, or at least the ones concerning Tether. But none of this happened.

4. A new finacial equilibrium

In the end of 2017 Noble account amounted to 3.3 billion dollars, when just a year before it had in custody only 191 millions. Today there are voices of about 4 billions only in the Bitfinex account. The growth of Noble mirrors the Tether growth, like Bitmex reports: https://blog.bitmex.com/tether-addendum-new-financial-data-released-from-puerto-rico/

But more surprisingly, Noble just became the richest account of the Bank of New York Mellon. There are big firms holding higher values, but in shares, bonds and other securities. Instead, the crypto exchanges need to guarantee full liquidity because the users might withdraw at any time, and the most liquid form the value can assume today is the bare dollar. This fact has something extraordinary: Bitfinex, the first exchange of cryptocurrencies in the world, holds the first account inside the biggest custodian bank of the world. On this basis, how the world will change in a few years?

Bitcoin in the last 7 years has seen an average daily growth of the 0.46% (see my arcticle about the bitcoin top ten holy rules). If in the next years we will see just a glimmer of this growth, the flow of money towards the exchanges like Bitfinex will be enormous. This fact may completely change the financial equilibria of the planet.

Since the 2008, the Federal Reserve pays a 0.25% interest tax for the exceeding reserves. To hold 4 billion dollars in a custodian bank which do not makes fractional reserve means to earn 10 million dollars per year, conceded by the FED “for free”. And these interests are not payed to Bitfinex, but to the bank hosting its account. As time passes by, the Bitfinex accont will increasingly trigger the cravings for cash money of the traditional financial institutions. At some point in time, companies like JPMorgan or Wells Fargo will understand the opportunity, and when the first “Big” make the inevitable step, all minor institutes will follow. There will be no more need to hide, no more doubt and fear in providing financial services connected to the cryptocurrencies. The inflated world of traditional banking, constantly under the threat of bank runs and credit crunch, won’t survive without that breath of oxygen represented by the crypto exchange accounts without fractional reserve. As Giancarlo Devasini (Bitfinex CFO) said: sooner or later, the biggest institutes will find out the inevitable and we will hear them shouting out: “it is better to mate with them!”.

Speaking of Giancarlo, I had the fortune to meet him. While discussing about these topics, I was speculating that in five or maybe ten years Bitfinex (or anyway another crypto exchange) will be the biggest bank in the world. He didn’t answer, but I found his sly glance very expressive, like a written sentence: “sonny, don’t tell me the obvious…”.

And this is the first phase. In the second phase the crypto exchanges won’t be needed anymore.

Read my other arcticles in english:

- The good bitcoiner’s top ten holy rules

- That’s why Bitcoin is superior compared to the other cryptocurrencies

- Guide to Lightning Network